Markets Are Falling | A Potentially Massive Opportunity Is Unfolding

Now, this post is not typical for Angel Powwow. Instead of focusing on startup investing, I’m going to take a moment to discuss the decline of the stock market and the potential for incredible growth.

Usually, I wouldn’t take the time to write a post titled “Markets Are Falling,” but the recent market uncertainty has left an opening that simply can’t be ignored.

If this is not your thing, that’s fine. Just skip this post, hit the forums, and stick with angel investing. I just want to let members know that, if you’re considering investing in the stock market, there’s no time like the present to do so.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY AFFILIATE DISCLOSURE FOR MORE INFORMATION.

Table of Contents

Let’s take a look at why…

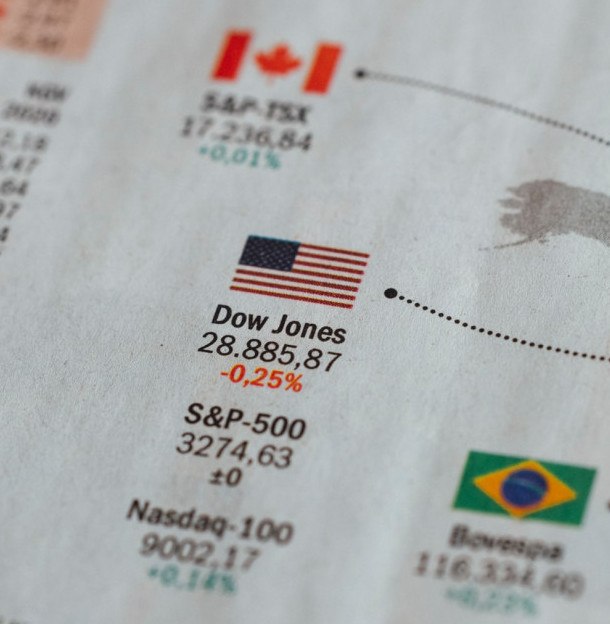

Markets Are Falling

I’m amazed at how a single virus has humbled the stock market. Yes, I know that uncertainty always makes it dip, and these are some uncertain times for sure. I suspect that a large part of this has to do with how hard China was hit by this virus, as so much these days happen to be made in there.

Because of this, production has virtually come to a halt. Manufacturing, shipping, and so on have all been affected. It doesn’t matter what the product or service is, if it has anything remotely related to China, it’s taken a hit.

As such, the companies that rely on China’s resources (labor, logistics, materials, manufacturing, etc.) have all taken a hit on the markets. As I’m sitting here, writing this post, trading has been stopped on the market due to a considerable point loss in less than 2 hours of trading today.

It just seems like doom and gloom lately.

What’s next…

How Bad Will It Get?

That’s the big question.

The stock market is always a mix of varying investment strategies. Some people have a set plan and will invest based on that plan, no matter what. Others will invest emotionally (a very erratic and dangerous way to invest). Yet more will analyze over and over again until they’ve missed their opportunity because they never took action.

Right now, I think most people are trading based on emotion and panic. I can’t say when that panic will die down but, from what I’ve seen today, we haven’t reached that point yet.

There’s a lot of panic and uncertainty going around. Now that the market has slid significantly, there’s also the flash-mob mentality that says, “I need to sell now before I lose anymore.” This just exaggerates the situation.

I can’t say how much worse it will get but, there’s a bottom to everything, and this is no different.

What action(s) do we take…

What Should I Do?

I can’t tell you what to do. Your situation is unique. You have different tolerances; your investing strategy will vary from mine, and so on. What I can say is that there’re opportunities to be had from this situation, and you should consider looking into your options.

The way I see it, the market has fallen significantly. You can hold off to see if it starts to get better, or you can start investing now. There are three potential outcomes

- You begin now, and the market still falls more. Yes, you’ve lost some money but, chances are, the market will recover and, when it does, your standing will be better than when you “bought-in.”

- You can wait and try to get in at the very bottom. This will give you the best shot at making the most money, but you really can’t tell when the bottom has hit until it climbs back up. Of course, once it climbs back up, you’ve lost that extra bit between where it is now and the actual bottom.

- You invest, and the market completely crashes, causing you to lose it all. Is it possible? Yes. Is it likely? I don’t think so. The world has too much at stake to let that happen.

Personally, I’m looking at tossing my hat into the stock market ring just a little. I’ve never been much of a stock guy, but I see great potential in this opportunity.

I think a healthy way to invest is to create a hybrid of the methods listed above. Make a plan but leave flexibility for change, to address issues that arise that were not planned for at the beginning. Listen to your gut, unless your rational side has overwhelming evidence that you shouldn’t. Yes, absolutely research your intended investments, but don’t do it to the point where you never take action.

Consider looking at the traditionally successful stocks. Those large companies, whose individual stock prices have been almost too high to even buy one share, might be a perfect choice. I expect that these companies will bounce back pretty quickly once the panic subsides.

Now I’d like to make a personal comment…

A Side Note

I don’t want to down-play the current epidemic situation, but…

I honestly believe the Corona Virus is getting way over-hyped. Yes, people have died, and that’s a terrible thing. Yes, it’s spreading quickly. The issue I have is other diseases, like the Flu, have killed more people in the same amount of time, and we’re not losing our minds over it.

It’s to the point where simple household products like Lysol, Clorox Wipes, Purell, and so on are getting hard to find because people are so afraid of this virus.

The issue is that it’s something new, it’s getting a lot of press and notoriety, and this is just feeding the panic frenzy. This added hype is what’s leading much of the market instability and causing this slide.

I don’t mean to sound uncaring; I’m just trying to put this into a rational perspective. It’s bad. It’s unfortunate. But it’s not as bad as it’s made out to be and, certainly, not world ending.

Don’t let the hype ruin your chances to act on a rare opportunity.

Conclusion

As I write this, I know how I might sound to some people. Please don’t think I’m uncaring. I feel for those who are sick, the companies that are hurting because of this outbreak, and for those who have lost loved ones. I just don’t want everyone to fall into the hype being spun by the fear mongers out there.

View the situation from an outside perspective, weigh the “facts,” compare the statistics to other ailments and make a rational conclusion of your own.

Once you have your own researched conclusion and are comfortable with your personal standing on the issue, take a look around for the opportunities this situation has opened up for you. Act when you think it’s appropriate.

Now, I have a favor to ask of the Angel Powwow community…

Where do you stand on all of this? Am I way off-base? What opportunities do you see here? Are there any specific stocks you’re looking at? When do you think the market will hit or be close to the bottom?

I’d love to hear your thoughts. Let me know by commenting below.

Thank you,

AngelPowwow.com

Hi,

This is a great reminder and a good warning too. Falling markets can doom an investor if they’re not careful. At the same time, they present an awesome opportunity to buy at the right time and sell later at higher prices.

I think the uncertainty is predominantly caused by the second wave of the Corona Virus and it will last a few months. In the meanwhile, we can expect businesses to be hit due to lockdowns in a lot of countries around the world.

Thank you for doing this research for us. Regards,

Aparna

Hello Aparna,

Yes, investing is generally volatile, and your money is always at risk as long as it’s in the market. That said, buying low and selling high is the goal.

The Carona Virus is definitely playing a role. I actually sold a little over $3600 worth of stock on Friday, and here it is Monday, up 40%. I was thinking, “Oh, man! I could have held out and made another $800+…” Still, I can’t complain because, when I sold, I was already up 73% (not typical returns for many, but I just happened to be lucky).

Thank you for taking the time to comment,

Scott