Fantasy Startup, How To Invest In Startup Companies

Welcome to Fantasy Startup, How To Invest In Startup Companies, part one of my two-part review of Doriot and their offerings. Part 1 will focus on Doriot’s Fantasy Startup app (available for iOS and Android). Part 2 will dive into the Doriot Venture Club and what it brings to the table.

If you’re here, you’ve probably heard the following terms or phrases: angel investing, crowdfunding, investing in startups, etc., and you want to know more about it. More importantly, you’re looking for information on how to get started investing in this asset class yourself.

Unlike this shameless plug, referring you to my many articles on the subject, Doriot has taken a different approach. They have developed an app; with educational and simulation features; to help teach you some of the terms and aspects of investing in startups.

If you find this post helpful, please check out my other Educational posts for even more information.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY AFFILIATE DISCLOSURE FOR MORE INFORMATION.

Table of Contents

Let’s dig into the Fantasy Startup app to see what it has to offer…

How To Invest In Startup Companies

Arming you with the knowledge required to be successful is the real reason for the app’s existence. Doriot’s end goal is to educate the masses and get them to a point where they are knowledgeable and comfortable with understanding an opportunity, vetting it, and going through the investment process.

They are also working on getting this training recognized by the SEC; so that those who complete it and pass the course will be considered Accredited Investors under the Five Factors of Financial Sophistication clause. If successful, additional investing opportunities will open up to you as an accredited investor.

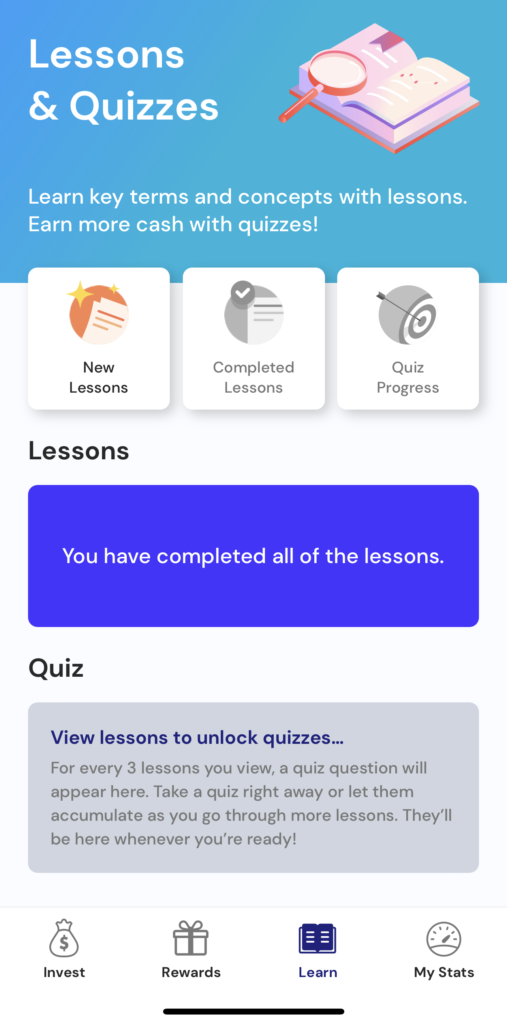

Doriot has loaded this app with 150 lessons, focusing on various term definitions; to help you understand them and how they apply to crowdfunding opportunities. Short videos and text content bring it all together. This bite-sized approach helps to keep you focused and prevents the more common flood of information that overwhelms the user that most other solutions provide.

Each lesson is also followed up with a quiz that, if passed, will add more virtual currency to your investment pool (more on that later) and count toward your overall course completion. You’ll need to pass a certain number of quizzes to complete the course officially.

Overall, Doriot does an excellent job imparting the knowledge you need to understand the terms, but learning modules and quizzes aren’t all they offer…

Simulated Investing

Yes, knowledge is critical, but applying that knowledge is just as important, if not more so. Enter the investment simulator.

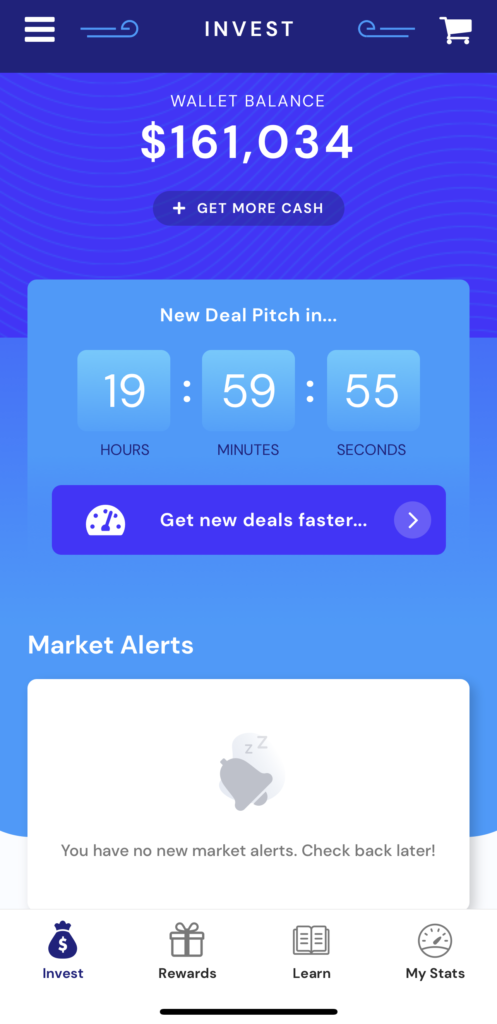

The Fantasy Startup app includes 50 opportunities that simulate what you might find in the real world. You’ll be presented with a brief video on the company and a short text snippet to help you vet the opportunity. Be sure you’re ready before you look at the opportunity; because you only get 5 minutes to review the data and make a decision.

Considering whether or not to invest in a particular opportunity isn’t just a yes or no decision either… You must figure out how much of your financial resources to devote to this opportunity-something you need to keep an eye on, as the money tree is limited.

Like in the real world, some companies will raise additional rounds, others will fail immediately, and a handful will have an exit event. For those offering additional funding rounds, you’ll receive another presentation with that same 5-minute time limit. It’s up to you to decide if you want to add more to that bucket or not. As for the exits, some may return high multiples, close to what you invested or even less than you initially put in.

As time passes, the app will notify you of new rounds, exit events, and failures. The experience is almost as if you’re investing in real life.

Now, I’m a bit strange, and I find that concept exciting already. Still, Doriot has added a few additional components to make the app more fun…

Gamification/Competition

Apps are great and all but unless you’re just looking to read a book or something, making it fun increases user interaction and learning retention.

Think of it this way: Can you remember that obscure equation from your high school junior-year math class? What about that year’s most famous song (or, better yet, every lyric in that song)? Chances are, you’re going to remember a lot more of that song vs. the equation.

Why is that? Because the song was fun and engaging. You probably played it over and over and maybe even bounced around a bit (I think they called it dancing, but a dancer I am not). It’s a good bet that you didn’t do the same with the math equation.

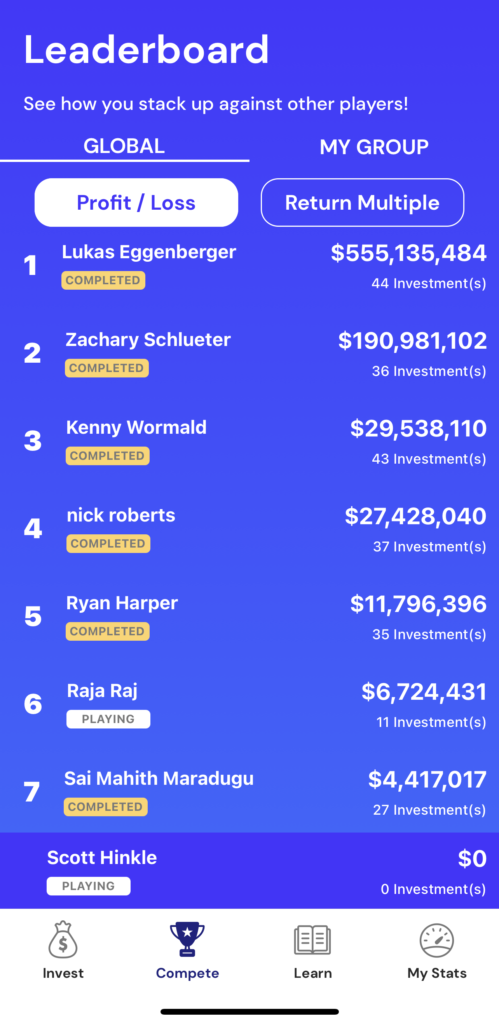

Doriot has gamified the app further by introducing competition. How are you fairing against other users of the app? Who has the higher return multiple? What about the overall profit/loss amount? You can compare globally or in the group you’re a member of (you can set up your group or join someone else’s).

Education and gaming are fun and good, but let’s talk about what truly matters when investing: Results…

What Truly Matters: Results

Ultimately, the goal is to absorb the knowledge, apply what you’ve learned, and become comfortable with the process. Remember, Doriot is trying to get you to a point where you’re a more informed investor. The more you understand the content and apply its teachings, the better off you will be.

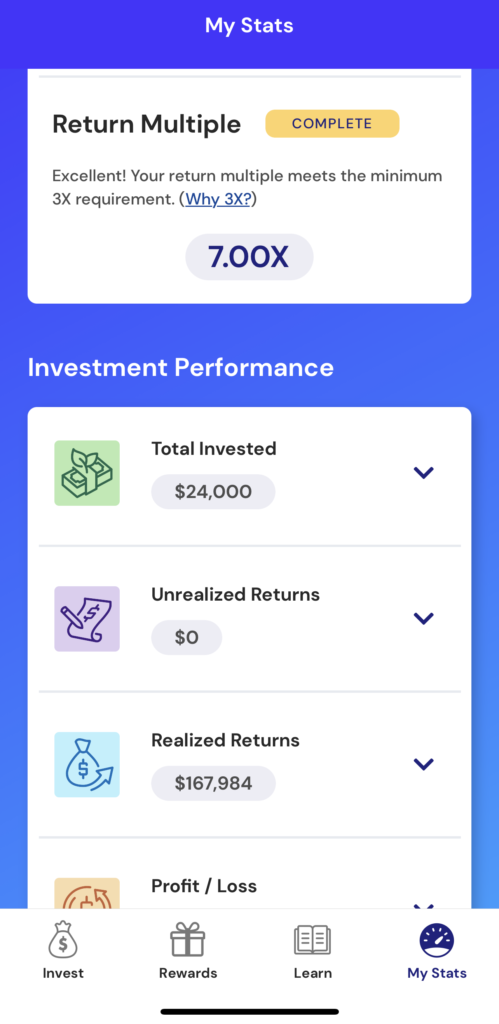

Results matter in this app. The goals are to:

- Invest in at least 25 startups

- Pass a minimum of 50 of the 150 quizzes (and frankly, you should strive for more than that)

- Earn a profit that meets the minimum required for certification

If you meet those goals, you’ll not only receive a certificate, but you can move on to joining Doriot’s Venture Pool (see below).

The Venture Pool is where you can invest your own real money in opportunities presented by Doriot to the members. Because Doriot is pooling resources (your investment and the investments of other members), you can get in on many deals for less than the minimum when investing directly. Investing as a group is an excellent way for those starting out or with limited budgets (think college students, etc.) to participate.

Let’s say the minimum investment for an opportunity is $500. For many, that’s a big chunk of change. Let’s say Doriot brings that opportunity to the pool. The pool needs to meet that minimum, not just the individual. You can invest as little as $10 in these opportunities; as long as the collective meets the minimum. Participating in a venture pool allows you to get your feet wet for real without breaking the bank! I’ll cover more of this in part two.

Conclusion

As you can see, Doriot came up with a fantastic way to teach people How To Invest In Startup Companies.

They took the idea, created an app, provided lessons backed by quizzes, and even created a simulated investing environment to test out your skills.

All-in-all, I think they did a great job.

Do I agree with everything they put forth? No. One of the requirements to pass their course is to invest in at least 25 opportunities. The issue is that they only present you with 50 prospects in total. I get the whole diversification idea, but I fear this particular piece gives people the idea that they should invest in 50% of the opportunities they see. I can’t entirely agree…

Yes, you should diversify, but that doesn’t mean you should be investing in every other opportunity that crosses your desk. Be sure to review, vet, and understand it. If it passes your due diligence process and aligns with your investment policy, invest in it. If not, don’t. I’ve found that I might invest in five to 10 percent of the deals I encounter.

Still, if that’s my only gripe, it’s worth checking the app out for yourself. Look for Fantasy Startup in the iOS or Google Play app stores or visit doriot.com and follow the links.

I hope you found this post informative. I’d love to hear your thoughts. Have a question, concern, or additional information you think should be shared here? Please leave a comment below.

If you’re looking for a social platform focused on angel investing and crowdfunding; where you can discuss opportunities and connect with other investors, consider joining Angel Powwow.

Thank you,

Scott Hinkle

Responses